- Index Futures

- Bond Futures

- Foreign Exchange Futures

- Energy & Metal Futures

- Agricultural Product Futures

- DJIA

-

The Dow Jones Industrial Average is the oldest stock index in the world, which was created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow in 1884. There were no rules in the initial index selection. Then it was prepared by The Wall Street Journal in October 1896, and the component of stocks increased from 20 to 30, and has been used until now. The Dow Jones Industrial Average is one of the world's most famous and respected stock indexes. The index includes a portfolio of 30 top blue-chip companies listed on the New York Stock Exchange, which accounts for a fifth of all US stock market capitalization. As a result, CBOT launched a new futures contract based on the Dow Jones industrial average to all investors.

- S&P

-

The Standard & Poor's 500 index was published by McGraw Hill Financial, Inc., and is calculated by equity weighting method based on 500 large companies listed on NYSE or NASDAQ, including 400 industrial stocks, 50 public utility stocks, 40 financial stocks and 20 transportation stocks. Because the market capitalization included in S&P 500 index covers more than 80% of the total value of New York Exchange, and the factors such as market liquidity and industry representative are considered in the stock selection. So that S&P 500 has become popular among institutions and fund managers and an important reference pointer to the market trend after it was launched. S&P futures contracts are the standardized contracts derived from S&P 500 index and the most recognized stock index futures in United States. However, the high contract value limits the participation of small traders. Therefore Chicago Mercantile Exchange launched E-mini S&P futures contracts and they were widely accepted by investors. E-mini S&P futures contracts track the Standard & Poor's 500 index, but the contract value decreases from USD 250 to USD 50, and they are traded in electronic system. Finally, one principle of the S&P 500 Index is the constant 500 Constituent stocks included in the index, adding a new stock and deleting an existing stock happen in the same time.

- NASDAQ

-

The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed in Nasdaq Stock Market (So far about 5400 listed companies) based on market capitalization. The index was first calculated by Capitalization Weighting method in February 1, 1985, and the base price of the index was initially set at 250, to ensure the index is not distorted by the increase and decrease of a few large components. After December 18, 1998, the calculation method of the index was adjusted to Modified Capitalization Weighting, and the index was re-assessed each quarter, and 100 constituent stocks were separated into large cap stocks and small cap stocks. The Nasdaq 100 Index Composite Index every 15 Seconds, the Nasdaq 100 Index and the Nasdaq Composite Index have a correlation of more than 94%. The constituent stocks include the famous large enterprises such as Cisco, Microsoft, Intel, Oracle, QUALCOMM, Sun Microsystems, JDS Uniphase, VERITAS, Siebel, Amgen and so on.

- Bond Futures

-

Bond futures contracts are the futures contracts that promise to buy or sell the specific fixed income securities in the future, and the contract price fluctuates based on the movement of interest rate. Bond futures contracts are generally regarded as a main tool for hedging long term interest rate risk. The maturities of bond futures contracts range from five year to ten year. There are two main risks of bond futures, which are interest rate risk and default risk. Interest rate risk or called reinvestment risk is the risk of the bond price movement results in the change of interest rate risk during the holding period. Default risk is that the issuers have trouble paying interest or principal due to financial difficulties. Generally speaking, high yield bonds with higher risks are more attractive to investors.

- Currency Futures

-

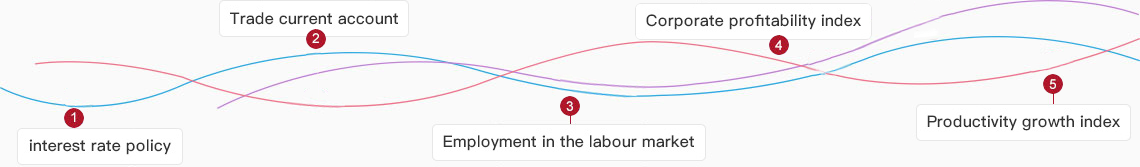

Currency futures contracts are the standardized contracts that buyers and sellers agree to trade a specific currency in a specific time of future. Type, quantity and trading month must be clearly stated in the contracts, in order to the convenience of trading. Investors can close out the contracts before the expiration Date, so that cash or physical delivery is unnecessary.

Currency futures are quoted on a non-dollar basis, which is the relative US dollar price per unit of foreign currency.

The more active currency futures contracts include Euro, British Pound, Australian Dollar, Canadian dollar, Japanese Yen, Swiss Franc, New Zealand Dollar, Euro-Yen, China Yuan and US Dollar Index.

Affecting Factors

1.Import and export

2.Growth of economy

3.Consumption

4.Productivity

5.Movement of capital

6.Interest rate level

7.Sovereign rating

8.Freedom to trade

9.Political environment

- Light Crude Oil Futures

-

Over the past decade, light crude oil futures are currently the world's most actively traded commodity futures, due to its excellent liquidity and price transparency. The light crude oil futures contracts launched by NYMEX have become the most traded commodity futures, and popular among international investors and futures players.

The world's major oil producing countries are America, Canada, the Middle East, and Venezuela and so on, but the main oil exporting countries are the politically unstable areas such as the Middle East, Indonesia and Venezuela. Any bad news like coup, strike, conflict or well accident will pressure oil price goes up.

- Gasoline Futures

-

Reformulated Gasoline Blendstock for Oxygen Blending (RBOB) is an uncompleted gasoline, and a mixture of light gasoline and petroleum brains. Gasoline is one of the largest lightweight petroleum products and is used as fuel for transport, so that the demand increases during the peak travel season. In 2006, NYMEX launched gasoline futures contracts to replace unleaded gasoline contracts, which makes RBOB gasoline futures contracts became the main gasoline futures contracts. Then NYMEX was also in close contact with the federal government and the state government. The price of RBOB Gasoline futures accurately reflects the overall spot market with the continuous development of supervision.

- Natural Gas

-

Natural gas, which is considered one of the alternative sources of oil, is found mainly in oil fields and gas fields, or a small percentage in coal beds. The main uses of natural gas are power generation, natural gas vehicles, heating/ cooling, fertilizer and so on. Natural gas is in the unit of Therm. The main natural gas producers include United States, Russia, Iran, and Saudi Arabia. In 2009, United States produced more natural gas than Russia, and became the world’s largest producer. Natural gas accounts for about a quarter of U.S. energy consumption, so that the price of NYMEX natural gas futures contracts is widely used as the national benchmark price.

- Heating Oil Futures

-

Heating oil is also call NO. 2 fuel oil, and about 25% output of a barrel of crude oil is heating oil. At the early stage, heating oil futures attracted the participation of the wholesalers of heating oil and the terminal consumers with huge consumption, later these investors turned to hedge against diesel and aviation fuel with them. Today, more participators, such as Oil refinery wholesalers, heating oil retailers, shippers, airlines and ocean shipping companies, are attracted by heating oil contracts as a tool of risk management.

Affecting Factors:

1.The trend of OPEC

2.The political and economic situation of major oil producing countries

3.The influence of war, blockade, embargo or economic sanctions

4.Accidents with tubing and storage tanks

5.U.S. oil supply and demand data

6.The development of alternative energy

7.Government policy

8.Global economic situation

9.Demand from Industrial development

10.Seasonal factors

- Gold Futures

-

Currently there are 12 gold futures markets and 8 gold spot markets in the world, and the trading time is nearly 24 hours a day, gold price index markets in the world include Zurich, London, New York and Hong Kong exchange. The world's largest futures market is New York Mercantile Exchange (COMEX), followed by Tokyo Industrial Goods Exchange (TOCOM).

The largest proportion of gold demand is from jewelry and industry; the others are from minting and the purpose of storage. Meanwhile, the demand of precious metal is related to national monetary policies. The main determinants of gold price are the role of international trading medium and storage value, and the change of industrial demand has little effect on it. Because US dollar plays an important role in the international financial system. When dollar is strong, gold price is forced to depreciate; conversely, gold price is forced to appreciate when dollar is weak. So that the factors that affect US dollar also have an impact on gold price. In addition, crude oil price is an important determinant to gold price. The rise of oil price is a harbinger of inflation, and it forces gold price to increase. The political factors in the oil producing countries and the relationship between gold price and other precious metal prices are also the important factors to gold price.

- Copper Futures

-

Copper is the largest non-ferrous metal used in industry, also called Red metal, and the first metal futures contracts in the world. Bronze is the alloy of copper and aluminum and brass is the alloy of copper and zinc. Copper is widely used in power lines and construction, because of its excellent ductility, corrosion resistance and electrical conductivity. Two of the world's most familiar copper futures markets are New York mercantile Exchange (COMEX) and London Metal Exchange, which launched copper futures contracts in 1933 and 1883 respectively.

- Silver Futures

-

Currently there are 12 gold futures markets and 8 gold spot markets in the world, and the trading time is nearly 24 hours a day, gold price index markets in the world include Zurich, London, New York and Hong Kong exchange. The world's largest futures market is New York Mercantile Exchange (COMEX), followed by Tokyo Industrial Goods Exchange (TOCOM).

The largest proportion of gold demand is from jewelry and industry; the others are from minting and the purpose of storage. Meanwhile, the demand of precious metal is related to national monetary policies. The main determinants of gold price are the role of international trading medium and storage value, and the change of industrial demand has little effect on it. Because US dollar plays an important role in the international financial system. When dollar is strong, gold price is forced to depreciate; conversely, gold price is forced to appreciate when dollar is weak. So that the factors that affect US dollar also have an impact on gold price. In addition, crude oil price is an important determinant to gold price. The rise of oil price is a harbinger of inflation, and it forces gold price to increase. The political factors in the oil producing countries and the relationship between gold price and other precious metal prices are also the important factors to gold price.

Affecting factors:

1.The trading of central banks and international institutions

2.Investment demand

3.Industrial demand

4.The impact of international stock prices

5.Currency rate

- Corn Futures

-

United States has been the world’s largest corn producer for many years, and produces about 42.1% of global output every year. China is the second world’s largest producer, but the corn yield is only 40% of American output. Other countries, like Brazil, Mexico, France and Russia, only produce a fraction of global output.

The utilization of corn is nearly 100%, corn can not only be used as feed, but also be processed into other products. Starch can be produced by corn wet milling, and can be used in paper, textile, washing and food industries. Starch is also one of the raw materials of candy and food.

- Soybean Futures

-

Soybeans can be both edible and processed cooking oil, and soybean flour and soybean oil that made by soybeans has become the important by-product because of its Characteristics of high protein and fat.

United States is the world's largest soybean producer, accounts for more than 50% of global production. Soybeans are mainly from south of the great lakes because of its suitable climate for the growth of soybeans. Chicago has become an important grain spot and futures trading center in America. Except America, Brazil, China and Argentina are the important soybeans producers. However, China produces soybeans mainly for self-sufficiency, so the main producers of soybeans are America, Brazil and Argentina.

- Cotton #2 Futures

-

Cotton is widely used as materials of fabric or garment because of its versatility, comfort and durability. In addition, natural fiber of cotton is better than other natural fiber in both strength, intensity of color, washes durability and the characteristics of easy to process.

The main cotton producers are America, China and Russia, which account for two-thirds of global output. NYBOT is the main cotton exchange in the world.

- Sugar #11 Futures

-

Sugar is natural sweetener and mainly from the crystallization of cane and beets. Sugarcane is gramineous plant, and mainly distributed in tropical and subtropical regions in the world. Sugar becomes raw sugar after a preliminary refinement, and Sugar #11 Futures of NYBOT are raw sugar futures contracts.

Sugar is mainly used to produce food and drink, such as Grain products, candy, chocolate, canned fruit, ice cream, beverages or concentrated juice.

- Orange Juice Futures

-

Brazil and America are the main orange juice producers in the world, which accounted for 51% and 40% of global output respectively. The orange juice demand and supply of America and Brazil are the main influence of the price of orange juice futures, and the USDA reports from United States Department of Agriculture also put pressure on the price of orange juice. On the other hand, climate, especially in Florida, is another factor influencing orange juice price, like Frost Damage in winter and typhoon in summer. In typhoon season in Florida, the price of orange juice fluctuates greatly once there is a typhoon.

- Coffee Futures

-

Coffee has a long history, mainly as a drink. Generally, the sunniest areas are the best coffee localities. Coffee producers must classify coffee by size and designate its class before shipping. In addition, Coffee beans can be stored for a long time. NYBOT only trades futures contracts of Type C coffee beans (Arabica coffee beans). Coffee beans price will be adjusted at the time of delivery, based on the standard price of different countries. The main trading months of type C coffee beans are March, May, July, September and December, and each contract is worth 37,500 pounds.

- Cocoa Futures

-

Cocoa trees are tropical plants; growth sector of cocoa is between 20 degrees south and north; about 30 major growth regions are in the world. The demand of cocoa is huge because it can be processed into drinks and chocolate. The main harvest of cocoa is from October to March, and more than 3/4 of cocoa production is at that time, and the secondary harvest is from May to August.

A common character of cocoa and coffee is that most of their production countries are from backward third world countries but the consuming countries are from developed countries. Because of the different areas of production and consumption of cocoa, two-thirds production of cocoa trade internationally. America is the largest consumer country, followed by Germany, Holland, Brazil, Britain, and France and so on.

Affecting factors:

1.Demand and supply

2.The development of substitution

3.Inventory

4.Seasonal factor

5.Acreage

6.Political factors

7.The demand and supply report released by the US government